I Want Out: Dealing with Contracts in the Time of Corornavirus

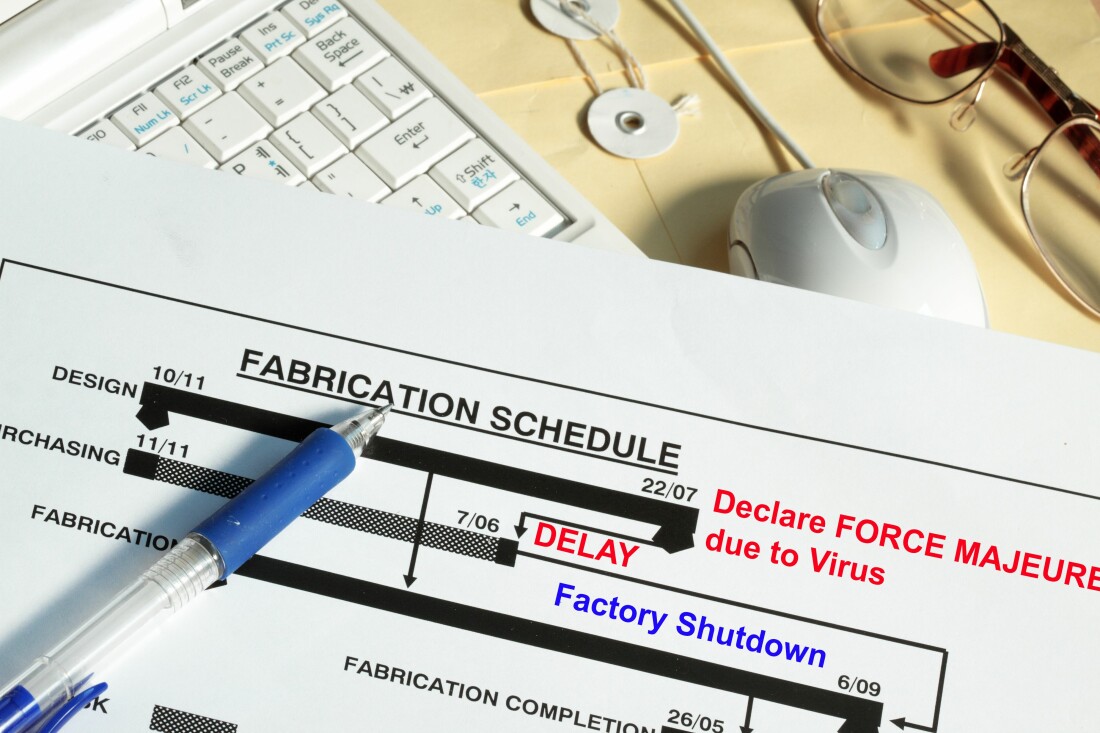

In March 2020, we published an article about how the Coronavirus impacts your contracts and whether force majeure clauses could excuse non-performance. Since then, our attorneys have received a number of questions from clients related to the Coronavirus/Covid-19 and how our clients may address issues of performance, delivery, and payment when the Coronavirus impacts a company’s ability to complete its responsibilities under a contract.

In March 2020, we published an article about how the Coronavirus impacts your contracts and whether force majeure clauses could excuse non-performance. Since then, our attorneys have received a number of questions from clients related to the Coronavirus/Covid-19 and how our clients may address issues of performance, delivery, and payment when the Coronavirus impacts a company’s ability to complete its responsibilities under a contract.

As a country, we have seen the Olympics, music events, sporting events, Broadway performances, and many other events cancelled as a result of the Coronavirus. Many companies have struggled to address the cancellations without facing massive financial impact, but without proper prior planning, the last few months have been financially difficult.

Force Majeure Clause

If any issues arise and your business ends up in court, the court will evaluate a contract and interpret the contract as written. Many contracts contain boilerplate provisions known as “force majeure” clauses. Generally, a force majeure clause is used to excuse non-performance when performance becomes impossible. Whether or not a business’s circumstances rise to the level of being “impossible” will depend on a number of factors; however, a clearly written contract with a strong force majeure clause is essential.

Drafting a strong force majeure clause will depend on the facts and circumstances of a business and the transaction into which it is entering. These concepts not only apply to contracts for services, but also apply to contracts for the sale of goods which include terms and conditions. If your company regularly uses terms and conditions in its business, those terms and conditions should also be evaluated to determine whether they may be strengthened in light of the Covid-19 pandemic. Businesses that have a strong force majeure clause that covers such an event may still have to comply with other contract requirements such as notice provisions.

UCC and Impracticability

This does not mean that if a contract does not include a force majeure clause or has a force majeure clause that does not address pandemics, there may be no relief for a party who cannot perform. If your contract covers the sale of goods, then the Uniform Commercial Code (“UCC”) may provide some protection. Under Article 2 of the UCC, a party that fails to timely deliver goods may in some cases assert the defense of commercial impracticability.

This defense will require: (1) the seller not to have assumed the risk of the unknown contingency, (2) the nonoccurrence of the contingency must have been a basic assumption underlying the contract, and (3) the occurrence of that contingency must have made performance commercially impracticable. Generally, foreseeability is a major factor to consider in this analysis. If an event was foreseeable, it is likely this defense cannot be raised.

Other Potential Options

In the event there is no force majeure clause in place, and the contract does not cover the sale of goods, there may still be defenses. Many states have common law doctrines dealing with frustration of purpose, impossibility of purposes, and/or impracticability of performance. Michigan recognizes the defense of impossibility and impracticability, but only in narrow circumstances. This means it can be difficult and costly to assert this defense. Going forward, legal exposure can be limited by addressing these situations in the contract.

As we continue to see changes related to the Coronavirus, it is important to consider how you and your business will address these concerns and adjust to the “new normal” on a prospective basis. In the past, force majeure clauses have been seen as mere boilerplate terms required in a contract, but rarely exercised. Moving forward, it is time to revisit your contracts and determine how you can prepare for the next several months and into the future.

Our Foster Swift business attorneys are able to evaluate how your contracts can be drafted going forward to take the concerns raised by the Coronavirus into consideration.

Categories: Contracts

Amanda Dernovshek is an employee benefits attorney in our Business and Tax group. Her practice focuses on issues related to employee stock ownership plans (ESOPs), non-qualified deferred compensation plans, qualified retirement plans, and general business planning. Amanda also assists the Firm’s mergers and acquisitions team.

View All Posts by Author ›Categories

- Domain Name Registration

- Entity Planning

- Tax

- Inspirational

- Insurance

- Legislative Updates

- Employment

- IT Contracts

- Did you Know?

- Social Media

- Liability

- Fraud & Abuse

- HIPAA

- Licensing

- Elder Law

- Personal Publicity Rights

- Artificial Intelligence (AI)

- Alerts and Updates

- Compliance

- Chapter 11

- Cloud Computing

- Sales Tax

- Privacy

- Startup

- Copyright

- Criminal

- News

- Contracts

- Entity Selection, Organization & Planning

- Financing

- Electronic Health Records

- Hospitals

- Digital Assets

- Venture Capital/Funding

- Mergers & Acquisitions

- Defamation

- Technology

- National Labor Relations Board

- Regulations

- Employee Benefits

- Tax Disputes

- Trademarks

- Intellectual Property

- Corporate Transparency Act (CTA)

- E-Commerce

- Labor Relations

- Trade Secrets

- Lawsuit

- Distribution

- Billing/Payment

- Cybersecurity

- Estate Planning

- Retirement

- Hospice

- Sales/Disputes

- Department of Labor

- Crowdfunding

- Patents

Share

Share